How To Reduce Labor Costs: 9 Strategies

Try When I Work for free

Labor costs are one of your biggest expenses. So managing them has a direct impact on your bottom line. The good news is that it’s easy when you use software like When I Work. You’ll be able to quickly see how much overtime you’re using, and make changes on the fly to reduce your labor costs, right within the schedule.

In this comprehensive guide, you’ll delve deep into understanding the intricacies of labor costs, why they matter, and their significant impact on a business’s bottom line. You’ll also learn about the factors that drive up these costs, such as overtime and various labor laws, and discover nine actionable strategies to decrease them.

According to statistics from the U.S. Department of Labor, labor costs are one of the largest expenses any company has to absorb. In the retail industry, they average roughly 20% of total revenue—even more than the cost of inventory on hand in most cases! Other industries, including the food and hospitality fields, often see that percentage come in closer to 30-35%.

For small businesses, labor costs can gobble up earnings in a heartbeat if risk factors aren’t actively monitored and adjusted—or employers aren’t in compliance with the newest labor laws.

Key takeaways

- Labor costs, which include wages, benefits, and taxes, are major expenses for businesses, with sectors like retail and hospitality often dedicating up to 50% of their revenue to these costs.

- Overtime is a significant factor in rising labor costs, with businesses often facing massive overtime bills.

- Adapting to strategies like accurate staffing, improving employee efficiency, and automating certain tasks can dramatically reduce labor expenses.

- Implementing a clear overtime policy can help shift the overtime culture, ensuring it remains the exception and not the rule.

- Using tools like When I Work can offer real-time labor cost insights, helping businesses stay within their budget.

Before you can jump into solving problems and decreasing labor costs, you need to figure out what is driving them so high in the first place. It helps if you have a better understanding of how to calculate them and how they can quickly spiral out of control.

Before you can jump into solving problems and decreasing labor costs, you need to understand what they are. It helps if you have a better understanding of how to calculate them and how they can quickly spiral out of control.

What are labor costs?

There are really two types of labor costs, but they both represent the total wages, benefits, and taxes that a business pays out for employees. Direct labor costs are what you pay to one of your employees who helps you produce a good or service, like a hostess who works in your restaurant. Indirect labor costs are those you pay to an employee who helps another business provide a good or service to you, like a plumber who comes to fix a sink in your store restroom.

How to calculate labor costs

Take your total revenue from sales and divide it by your total payroll. Be sure to include the cost of any benefits packages your company offers as well. A solid labor cost percentage goal to shoot for in retail (durable or non-durable goods) is 15%-20%, while in the restaurant industry, 30% is considered “safe.”

For example, if your total payroll is $20,000 and your total revenue is $100,000, your labor cost percentage is 20%.

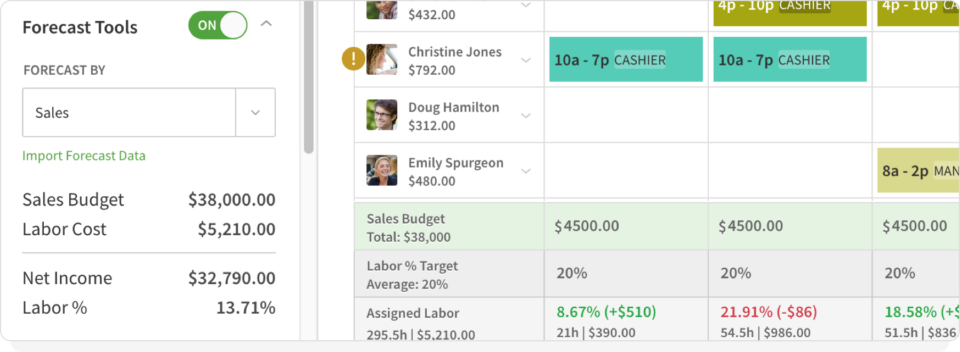

Want to be able to check in on this more often? Start using employee scheduling software that has labor cost dashboards. When I Work is free and will show you your actual and projected labor costs on the home screen as well as show you the cost of labor as you create the schedule, and provide a labor breakdown report for you as well.

Free labor cost calculator

If you need to know how much your labor is costing you now, check out the When I Work free labor cost calculator. You’ll be able to keep track of your labor costs more efficiently, save time on the calculations, and use the data to make changes that will boost your bottom line.

Strategies for decreasing labor costs you can try today

Knowing what labor costs are, and how to calculate them is one thing. But, how can you decrease labor costs, and get control of your budget? We’ve got you covered with nine ways you can decrease those labor costs.

1. Ensure accurate and adequate staffing

Making sure that you have enough people on hand and in reserve to handle the amount of business you’re doing and to cover emergencies such as sick calls is an important part of preventing excess overtime. Of course, being able to do this hinges on your ability to compile accurate predictions of your company’s sales and production on a daily—and even hourly—basis.

Once you have these predictions in place, examine your schedule to ensure that you have just enough employees available to handle that load. Don’t have a good way to access or edit the work schedule?

Use an employee schedule maker. If not, consider rescheduling or even hiring part time employees to fill in the gap, rather than relying on overtime hours as a “cure-all.”

When I Work makes it easy to not only build the schedule, but also use the data to see if you’re staffing your locations in a way that makes the most sense for your business. You can use reporting to see how you could control labor costs, change staffing to increase customer satisfaction, and more.

2. Consider cutting hours of operation

Along with adequate staffing, see if your business hours actually reflect sales and business demand. Does your restaurant earn enough profit to make up for the labor costs of having a morning shift? Should your coffee shop close early after serving commuters on their way to work? Should your restaurant be open late on the weekends to catch the Saturday night crowd? Make sure having staff on the clock matches up with sales—and that it’s worth paying the additional cost.

3. Track employee hours

Keeping an up-to-date tally of how many hours your employees have actually worked—not just how many they’re scheduled for. This will allow you to spot potential overtime offenders before it becomes a problem. Look to your employee scheduling software. It should have overtime warnings so you can create the schedule more effectively and not overload single employees.

When I Work alerts you to potential overtime as you’re building the schedule, so you can avoid it in the first place. But, as we all know, things change during the week, so you’ll also get notifications if your employees are about to head into overtime hours during their scheduled shifts.

4. Enforce stricter clock-ins and clock-outs

Restrict early in-punches and late out-punches. And beware of buddy punching, when fellow employees clock in or out for each other. Even incremental overtime can have a dramatic effect on your labor costs, so it’s worth being strict.

You can use a time-tracking software that offers geofencing, so employees can only clock in when they’re on site (and you can restrict how early they can clock in), and it reminds them to clock out if they’ve left the workplace. You can also use photo clock-in to avoid buddy punching.

5. Cut shifts if necessary

Don’t be afraid to cut shifts if your daily business doesn’t support your current staffing load. It may not be the easiest decision, but the health of your business may depend on it. However, business owners beware: before cutting shifts or changing employee schedules, check if your locality has fair workweek laws. Fair workweek laws require employers to provide employees a “good faith estimate” of hours they can expect to work. If you need to make big scheduling changes, make sure they don’t come with potential penalties.

Using employee scheduling software like When I Work makes this easy. When you cut shifts, your team will automatically be notified of changes to the schedule so you can make sure employees don’t show up for shifts that are no longer needed.

6. Improve employee efficiency

Multiple industries report that their productivity actually decreases when employee hours increase. Why? More staff and more hours don’t necessarily make your business run any faster. In fact, overworked employees are more likely to make mistakes or have accidents on the job.

Instead, corporate offices and retailers around the world have been moving away from rigid job descriptions to more flexible plans. Effective cross training can allow a limited number of employees to accomplish more. It eliminates downtime, excessive overtime, and protects employees from burnout.

For example, if your hostess can jump in if a server goes home sick; she can keep diners happy without adding extra payroll. If you have a skilled barista who needs a break, someone from the kitchen can take over so they don’t leave for a job with more flexible hours. Likewise, if a cashier can stock shelves during slow times, your stock people can move on to other things or punch out early.

7. Automate certain tasks

Businesses throw away at least $1.9 trillion every year on lost productivity—without needing to. Today, it doesn’t take an employee on the clock to complete core business functions. Customer management systems and email programs make it possible for businesses to automatically respond to customer inquiries and reach out to prospective customers without an employee sitting at a desk.

Screening potential hiring candidates, employee onboarding, and sales reporting can all be automated too. Instead of accepting some tasks as the cost of doing business, see if you can help employees spend their time on the clock on what matters, and not add more labor costs for busy work.

An employee scheduling software like When I Work can automate the scheduling process so it only takes you a few clicks. That means you’ll save hours every week and you can get back to doing more important things for your business.

8. Offer employee incentives

Keeping your employees happy and incentivized is essential for the health of your business. Regular performance evaluations and employee advancement programs function as motivational tools to encourage employees to give and learn more. Merit-based raises and performance bonuses are a great option as well, but even something as simple as an extra day off per month can be motivation enough to get the extra cooperation you need.

9. Create an official overtime policy

Overtime is a culture as much as a cost. If your business doesn’t have an official overtime policy, it’s time to make one. Put to paper how overtime works, who approves overtime hours, and how employees will be paid for additional shifts. Consider putting a cap on overtime hours—whether that’s how much overtime employees can work per quarter or even the entire year. Once you have boundaries in place, people will be more likely to stick to them and treat overtime as the exception, not the rule.

What drives labor costs so high?

Despite what you may think, hiring more employees won’t have a huge effect on your labor costs as a function of sales. That’s because it’s not your hourly wages that are driving your labor costs sky high. It’s the overtime.

Many retailers and restaurateurs are forced to pay time-and-a-half wages or even double-time to employees who work over 40 hours in a given work week. Even salaried employees may be eligible for overtime rates if they work in excess of average hours, depending on how employee contracts are structured.

Changes to overtime rules

And overtime is about to get even bigger. Over the past year, new overtime laws expanded who is covered under overtime and eligible to receive overtime pay. Starting January 1, 2025, an additional 4.3 million workers were required to be compensated for overtime hours worked. In short: there will soon be more potential employees who can earn overtime than ever before.

New advanced scheduling laws

Changes to labor laws outside of overtime impact small business labor costs as well. New laws like fair workweek, parental leave, and living wage ordinances all equal higher costs for employers. Embraced by a growing number of cities and states, fair workweek laws require that employers create employee schedules in advance and pay employees a premium if their schedule changes, or if they’re asked to work outside their scheduled hours. Employers are no longer able to cut employee shifts unexpectedly, ask employees to “clopen”, or use just-in-time scheduling to help cut down on labor costs.

Higher minimum wage

Employers are expected to schedule better, but also pay more. While labor costs have gone up, so have employee wages. “Living wage” ordinances and legislation calling for a minimum wage of $15 an hour has increased hourly income past the federally-mandated $7.25 in cities and states across the country.

A living wage represents the hourly pay a worker must earn to support themselves and their family based on their location. With the majority of minimum wage workers not able to afford housing, a living wage ensures employees can meet minimum standards of living. But it also puts a new burden on employers. For example, under California state law, employers must pay a minimum of $16.50 an hour.

Healthcare, benefits, and more

Remember: labor costs don’t just include hourly wages. They also include healthcare, vacation time, bonuses, and sick leave. Over the last 15 years, the cost to cover one employee under group health insurance rose nearly 200% from $2,196 to $6,575—making it difficult for small businesses to afford to offer group health insurance at all.

While these laws are an effort to help employees have a better work-life balance and quality of life, they do have a secondary effect on a business owner’s bottom lines. Just one change to the equation can spell disaster, especially in retail and restaurant industries with already-thin margins.

Decrease labor costs with When I Work

Start your free 14-day trial of When I Work to see how you can use employee scheduling software to reduce your labor costs. As you build the schedule, you’ll get real-time updates to your forecasted labor hours, along with overtime alerts, that can keep you from going over your labor budget. It’s the easiest way to control overtime at the source, before it gets out of hand. Sign up today!

Reducing labor costs: FAQs

Q: What are labor costs and why are they significant for businesses?

A: Labor costs represent the total wages, benefits, and taxes that a business pays out for employees. They are significant because they can be one of the largest expenses for any company, with statistics from the U.S. Department of Labor revealing that in some industries, labor costs can take up to 50% of total revenue.

Q: How can businesses calculate their labor costs accurately?

A: To calculate labor costs, businesses should take their total revenue from sales and divide it by their total payroll. This should include the cost of benefits packages. Using tools like employee scheduling software, such as When I Work, can also provide labor cost dashboards for easier monitoring.

Q: What factors drive labor costs to become exceptionally high?

A: Contrary to common belief, it’s not just hiring more employees that drives up labor costs. One of the main contributors to increased labor costs is overtime accrual. Additionally, changes in labor laws, higher minimum wages, and increased costs associated with benefits such as healthcare can also significantly raise labor costs.

Q: How can businesses effectively reduce labor costs?

A: There are multiple strategies to reduce labor costs, including:

- Ensuring accurate staffing based on sales and production predictions.

- Adjusting hours of operation based on business demand.

- Actively tracking employee hours to prevent overtime.

- Enforcing stricter clock-in and clock-out policies.

- Reducing shifts where necessary, considering labor laws.

- Improving employee efficiency through cross-training.

- Automating certain tasks.

- Offering employee incentives.

- Creating a clear overtime policy.

Q: What role does automation play in reducing labor costs?

A: Automation can significantly reduce labor costs by handling tasks that traditionally required an employee. Today’s technologies allow businesses to automatically respond to customer inquiries, screen candidates, onboard employees, and generate sales reports, reducing the need for manual intervention and lowering labor costs.

Q: Are there risks associated with cutting shifts to save on labor costs?

A: Yes, before making major changes like cutting shifts, businesses must check to see if their locality has fair workweek laws. These laws may require employers to provide a “good faith estimate” of work hours and could impose penalties for sudden, uncommunicated scheduling changes.

Q: How does When I Work software help reduce labor costs?

A: When I Work is an employee scheduling software that provides real-time updates to forecasted labor hours and sends overtime alerts. This assists businesses in controlling overtime at the source, ensuring that labor costs remain within budget.