What’s The Difference Between Double Time, Overtime, And Time And A Half

Try When I Work for free

In this article, you’ll learn the critical differences between double time, overtime, and time and a half pay structures. You’ll understand how these pay structures are determined by both federal and state laws, and how they affect both employees and employers.

By the end of the article, you’ll be equipped with the knowledge to correctly calculate these different types of pay and understand when they should be applied. And you’ll find out that California is the only state with formal double time laws.

Paying hourly employees is much more complicated than it would seem.

The Fair Labor Standards Act (FLSA) is your guide—it defines when workers are determined to be on the clock, and which employees are exempt from FLSA rules. But state laws can add another layer of complexity on top of that. That makes handling complicated timesheets very difficult without some form of payroll automation.

Knowing the difference between double time, overtime, and time and a half—and when to pay each—is necessary to get payroll correct. We’ll start by defining what these pay structures are, and the best way to handle it all when it comes to calculating hourly employee wages.

At When I Work, we offer more than just employee scheduling. We also offer time tracking, which will help you keep track of employee overtime and the different pay rates you need to apply.

Before we get started, keep in mind that according to the FLSA, a workweek is considered to be seven consecutive 24-hour periods. You don’t have to have the same workweek for every employee group or location, but it does need to be documented and regular once you’ve selected it.

The FLSA doesn’t limit how many hours a day an employee over the age of 16 can be required to work.

“The app saves time, money, and A LOT of headaches. It pays for itself just in the labor cost of figuring time for payroll.”

– Richard Merritt, Administrator, Randolph Security

Key takeaways

- Double time, sometimes known as “double overtime,” is paying an employee twice their normal rate of pay, but it is not covered by the Fair Labor Standards Act (FLSA) and is generally not required except in specific circumstances or locations.

- Overtime pay is mandated by the FLSA for nonexempt employees who work more than 40 hours in a workweek, with some states having additional daily overtime laws.

- Time and a half refers to the 50% increase in an employee’s rate of pay for every hour they work overtime, but it may not significantly increase net income due to potential higher tax brackets.

- Employers should be transparent with their employees about the availability of double time pay to prevent confusion.

- Using tools like When I Work can help automate the calculation of these pay structures, making it easier to manage labor costs and comply with regulations.

Ready to start saving hours each week on building the schedule and managing the overtime pay rates? Start your free trial of When I Work today.

What is double time?

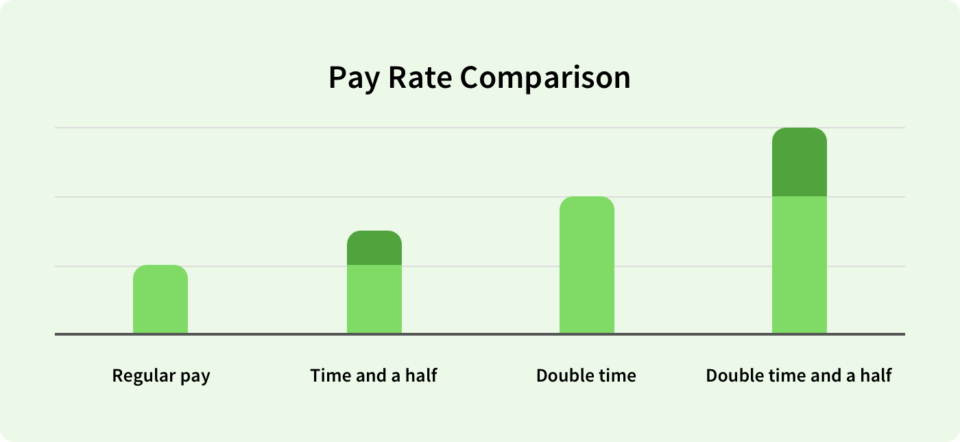

Sometimes known as “double overtime,” double time is paying an employee twice their normal rate of pay. If you earn $15/hr, you’ll get $30/hr with double time.

Here’s the thing: the FLSA doesn’t cover double time, and unless employers are paying employees in California or have union agreements that require it, they aren’t required to offer it.

Employers sometimes offer double time pay in order to fill unpopular shifts. Double time is sometimes paid for working on federal holidays or when hours exceed the normal workweek or workday, depending on employer policy.

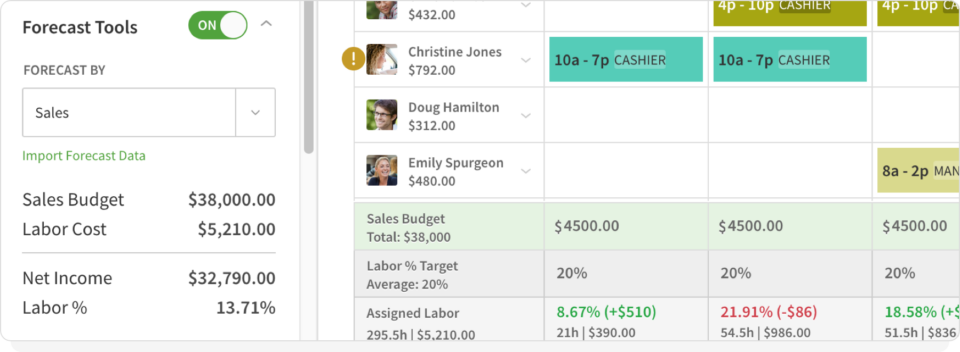

When you use When I Work, you can set the pay rate for the shift, making it easy for your employees to know that shift is worth more. Plus, you don’t have to keep track of that information, because the software does it for you.

How to calculate double time

Employer-offered double time calculations will be unique to that employer. In California, the only state in the U.S. with actual double time laws, the rules can be broken down as follows:

- Did you work 12 hours in a day? If yes, you should get double time for hours over that.

- Did you work 7 consecutive days in the current pay period? If yes…

- Did you work more than 8 hours on that seventh day? If yes, then you should get double time pay for hours over that.

Again, the state you live in, union agreements, and employer policy determines whether double time pay is an option for an hourly employee, as well as how it would be calculated.

Salaried workers who are eligible for double time have to convert their salary down to an hourly rate in order to apply the same rules.

What is double time and a half?

Double time and a half refers to a pay rate of 2.5 times an employee’s standard hourly wage. This enhanced rate is typically offered for working on holidays, overtime, or under specific circumstances outlined in employment agreements. For example, if an employee earns $20 per hour, double time and a half would pay $50 per hour.

What is overtime?

The FLSA requires that nonexempt employees (i.e. generally those who are not salaried, with some exceptions) are paid overtime when they work more than 40 hours in a workweek.

By law, no employee can waive overtime pay. Even if overtime occurs due to employee error, no employer can demand hours be made up without offering eligible overtime pay.

In some states, like Alaska, California, and Nevada, eligible employees must be paid overtime if they exceed eight hours in a day. Other states set different limits based on the kind of work employees are doing.

What this means is that employers may have daily or weekly overtime laws to follow. The FLSA only addresses workweek total hours, while states may address daily totals. It’s easy to see how being short staffed can quickly lead to exploding overtime costs, so for employers, it’s important to stay on top of overtime to reduce overtime expenses.

When you use When I Work, the software automatically tracks overtime for you. You can stop overtime before it starts, by getting alerts as you’re building the schedule. As the pay period progresses, you’ll get notifications when an employee is about to enter into overtime hours.

How to calculate overtime

To find out how overtime is calculated, determine if you’re dealing with daily or weekly overtime.

- What is the threshold? (8 hours per day or 40 hours per week).

- Add up your total work hours.

- Subtract the appropriate threshold from that total.

- If the number exceeds 0, those are your overtime hours.

When you use When I Work, the software will automatically keep track of the overtime hours for you. And with integrations to your favorite payroll providers, that information is sent automatically, so you don’t have to worry about doing the math.

Double time vs overtime

The main difference between double time and overtime is the pay rate. Overtime is typically 1.5 times an employee’s standard hourly wage for hours worked beyond the regular schedule. Double time is 2 times the regular hourly rate, usually paid for holidays, weekends, or excessive overtime hours under specific conditions.

What is time and a half?

Time and a half is in regards to the specific amount of pay someone would receive when they work overtime. It means a 50% increase in an employee’s rate of pay for every hour they work overtime.

Time and a half pay won’t necessarily increase an employee’s net income by much if it causes them to move into a higher tax bracket. Take-home pay might seem nearly the same or only incrementally higher if more taxes are taken out.

How to calculate time and a half

To calculate time and a half:

- Add up the hours of overtime = Overtime Total

- Multiply your regular hourly pay rate by 1.5 = Overtime Rate

- Multiply Overtime Total by Overtime Rate

Overtime vs time and a half

The main difference between overtime and time and a half lies in their definitions. Overtime refers to any hours worked beyond the standard workweek, typically over 40 hours. Time and a half is the pay rate for overtime, calculated as 1.5 times the regular hourly wage. For example, $20 per hour becomes $30 per hour under time and a half.

Common challenges for calculating overtime and time and a half

You might face some challenges in tracking time accurately, and managing multiple pay rates. The good news is that When I Work can help with both of these. Time tracking makes clocking in and out easy for your employees, and managing their timesheets is also simple. You’ll have reliable records to base your overtime calculations on. When I Work also makes it easy to assign pay rates based on the position a worker has. So if they do the job of multiple positions, When I Work handles the different pay rates and can send that info over to your favorite payroll provider through a seamless integration.

Understanding state laws

Make sure you know the laws in your state, as some have daily overtime laws. For example, overtime in the U.S. typically kicks in after 40 hours per week, but in California, overtime applies when an employee works more than 8 hours in a day.

Classifying employees correctly

Make sure you know the difference between exempt and non-exempt employees. Not all salaried workers are exempt and could be eligible for overtime. Misclassifying your employees can lead to unpaid or underpaid overtime, which puts your company at risk for owing back pay and non-compliance with state and federal laws.

Smarter labor cost control with When I Work

It’s easy to see how labor costs can get out of control if you’re short staffed, if you’re not tracking employee hours closely, or if you let your shifts get away from you. Having fewer employees to do more work isn’t a long-term solution when you keep these pay structures in mind.

Manually calculating these pay structures for multiple shifts and multiple employees—all while trying to schedule shifts to avoid runaway overtime costs—is difficult to do error-free.

When I Work automates much of this so that employees who hit overtime hours are automatically calculated at the correct rate. This is easier on you, more fair to the employee, and also makes it easy to track labor costs and overtime issues in real time. Overtime data is readily available; you can see which employees or shifts tend to accrue overtime and can make adjustments to reduce the problem. You can avoid fair workweek issues while still keeping labor costs under control.

To see all of this in action, sign up for a free trial of When I Work and find out how you can get your labor costs under control.

Double time vs. Overtime FAQs

What is the primary difference between double time and overtime?

Double time refers to paying an employee twice their normal rate of pay, while overtime typically refers to paying an employee an increased rate (often time and a half) for hours worked beyond the standard workweek.

Is double time covered by the Fair Labor Standards Act (FLSA)?

No, the FLSA does not cover double time. However, certain states like California or specific union agreements might require it.

When might an employer offer double time pay?

Employers might offer double time pay to fill unpopular shifts, during federal holidays, or when hours exceed the normal workweek or workday, depending on the employer’s policy.

How is overtime defined by the FLSA?

The FLSA requires that nonexempt employees are paid overtime when they work more than 40 hours in a workweek. Some states have additional daily overtime laws, such as paying overtime if employees exceed eight hours in a day.

What does “time and a half” mean in the context of overtime?

“Time and a half” refers to paying an employee a 50% increase in their standard hourly rate for every hour they work overtime. For example, if an employee’s regular rate is $10 per hour, their time and a half rate would be $15 per hour.

Can employees waive their right to overtime pay?

No, by law, no employee can waive overtime pay. Even if overtime occurs due to an employee’s error, employers cannot demand hours be made up without offering eligible overtime pay.

How can employers manage and calculate these pay structures efficiently?

Employers can use tools like When I Work to automate the calculation of double time, overtime, and other pay structures. This ensures accuracy, compliance with regulations, and helps in tracking labor costs in real time.