New Overtime Pay Rules Are Coming: How Business Owners Can Prepare

Try When I Work for free

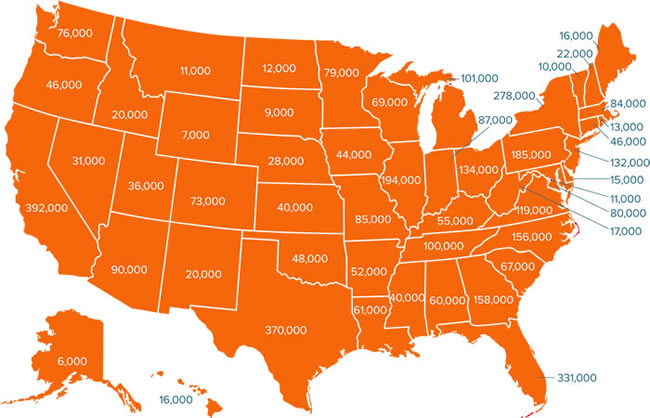

The U.S. Department of Labor just announced new regulations that will double the salary threshold for overtime pay from $23,660 to $47,476. The new rule, which takes effect on December 1, 2016, will create overtime pay eligibility for 4.2 million more workers across the United States.

For business owners, the regulations create new challenges that require immediate attention. In order to comply by December, businesses employing both hourly and full-time workers will need to make significant changes in terms of how they manage workers, track time, and pay wages.

Quick Facts About New Overtime Rules

Before making any changes to your business, it’s important that you take some time to understand the facts surrounding the new overtime rules. Here’s a quick summary of the most relevant information:

- Historically, the percentage of the U.S. workforce who qualify for overtime has fallen from 62% in 1975 to 7% today. The new regulations presented by the Department of Labor will now bring that number up to 35%, according this report from USA Today.

- The new rules will raise the salary threshold indicating eligibility from $455/week to $913 ($47,476 per year), offering new protections to 4.2 million additional workers (click here to see which groups of people the new rules will be affecting most).

Image Source: U.S. Department of Labor

- The salary threshold will be updated every three years based on wage growth over time, with the first update coming on on January 1, 2020 when the threshold will be raised to $51,000.

- The final rule will, as stated in this report from the Department of Labor, “allow up to 10 percent of the salary threshold for non-HCE (Highly Compensated Employee) employees to be met by non-discretionary bonuses, incentive pay, or commissions, provided these payments are made on at least a quarterly basis.”

- No changes will be made to the “duties test” that determines whether white collar salaried workers earning more than the salary threshold are ineligible for overtime pay.

- The final rule will become effective on December 1, 2016.

- For a more detailed summary of the final ruling, access this resource compiled by the DOL.

How to Comply: 4 Recommended Options

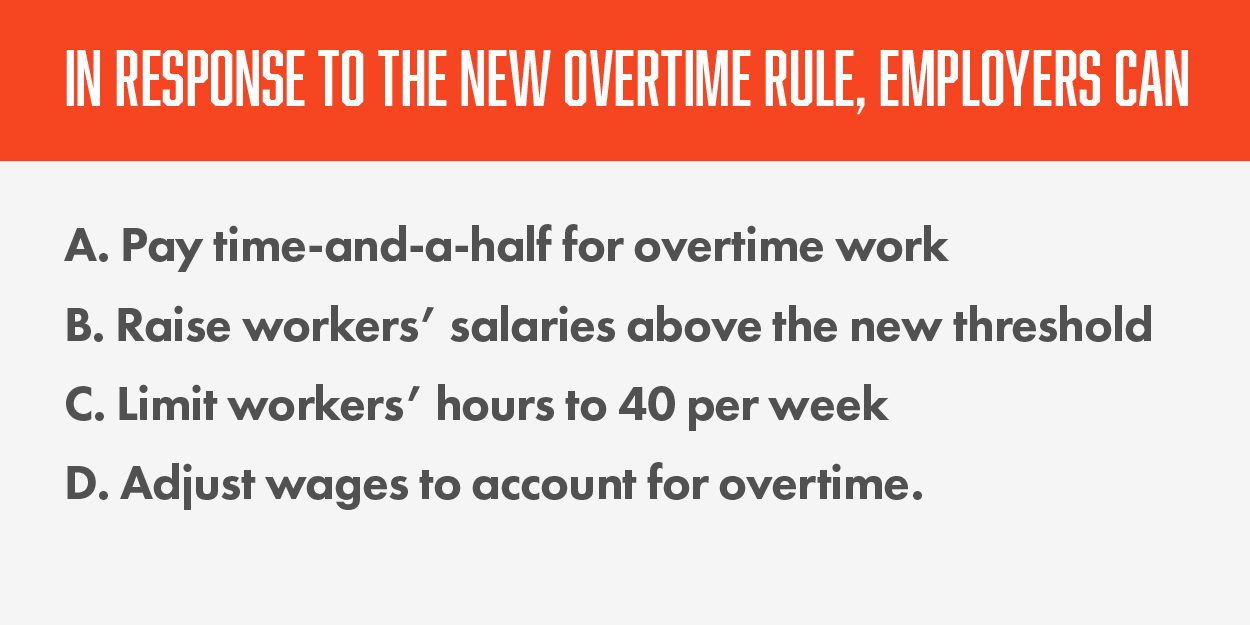

When it comes to developing a plan for your business that meets the expectation of the new rules set by the Department of Labor, you have a few options:

1. You could pay overtime in addition to the employee’s current salary when necessary. If your employees are being paid a salary and they only work overtime on rare, sporadic, or predictable occasions, you could continue to pay your newly-eligible employees the same salary and pay them overtime wages as needed. This option would work best for a business that can predict or plan for occasional spikes throughout the year in which employees tend to work more than usual and in turn can budget accordingly.

Example offered by the DOL: Alexa, a manager at an advertising agency, earns a fixed salary of $41,600 per year ($800 per week) for a 40 hour workweek. Because her salary is for 40 hours per week, Alexa’s regular rate is $20 per hour. If Alexa works 45 hours one particular week, the employer would pay time and one-half (overtime premium) for five hours at a rate of $30 per hour. Thus, for that week, Alexa should be paid $950, consisting of her $800 per week salary and $150 overtime compensation.

2. You could raise salaries to the new threshold and keep your employees exempt from overtime. If your employees are being paid a salary close to the new threshold, they regularly work overtime, and they meet the duties tests, you could simply raise their salaries to above the new threshold. This would make them exempt from overtime and allow you to better predict and manage your budget for paying wages.

Example offered by the DOL: An operations manager at an international corporation is paid a salary of $45,000 a year. Her job duties qualify her for the administrative exemption. The manager’s job requires regularly working overtime to direct business operations in multiple time zones. The employer may choose to raise the manager’s salary to at or above $47,476 a year to maintain the manager’s administrative exemption.

3. You could evaluate and realign hours and staff workload. If you want to prevent your employees from working too many overtime shifts, you can use employee scheduling software and time tracking software to monitor schedules and attendance more diligently. This will allow you to realign employee hours when needed, or encourage you to hire more employees to redistribute the workload each week.

Example offered by the DOL: John, a manager for a local hardware store who satisfies the duties test for the executive exemption, currently begins work at 9am Monday— Friday. Under the Final Rule’s new salary level, he would be newly entitled to overtime compensation. Among other duties, John works until the store closes at 7pm. The store may wish to adjust John’s schedule such that he doesn’t need to begin work until 10am, thus limiting the number of overtime hours he works.

4. You could adjust wages to account for overtime. For example, you could adjust earnings to reallocate it between regular wages and overtime so that the total amount paid to the employee remains largely the same.

Example offered by the DOL: Assume a supervisor at a private gym who satisfies the duties test for the executive exemption earns $37,000 per year ($711.54 per week). The supervisor regularly works 45 hours per week. The employer may choose to instead pay the employee an hourly rate of $15 and pay time and one-half for the 5 overtime hours worked each week.

In the example above, new the adjustments would work out like this:

[ $600.00 (40 hours x $15 / hour + $112.50 (5 OT hours x $15 x 1.5) = $712.50 per week ]

The option you ultimately choose will depend largely on the work habits of your employees, your budget, and the flexibility of your team.

The Easiest Way to Manage & Track Employee Hours

Under the Fair Labor Standards Act (FLSA), employers must consistently keep track of the hours that non-exempt employee hours work in order to ensure they are being paid fairly (i.e. above the minimum wage and for overtime hours).

The FLSA does not specify the tools or require certain methods that employers must use to track employee time—they simply require you to keep accurate records.

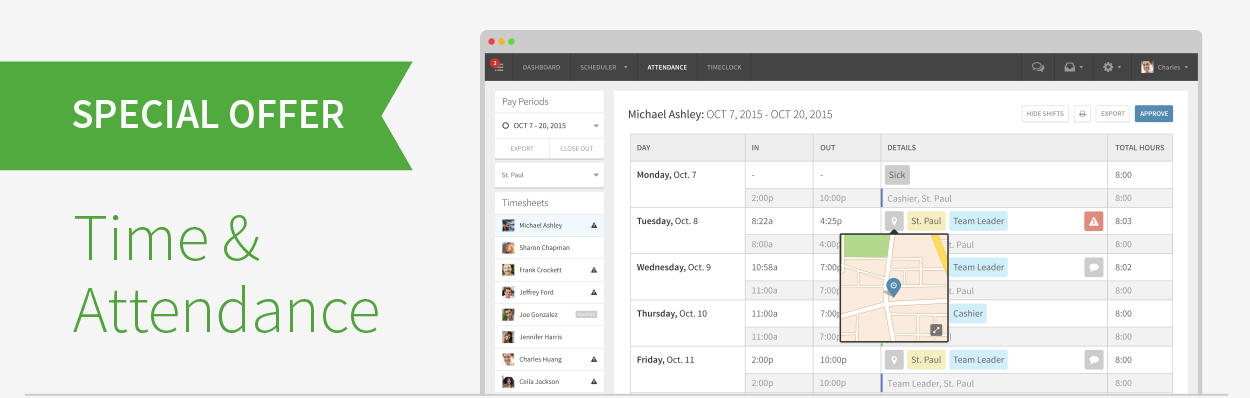

If you’d like to start tracking time for your employees now in preparation for the new overtime regulations going into effect in December, the easiest way to do it is by using a time clock and attendance software tool.

Ready to stop manually tracking employee time? Start your free 14-day trial of When I Work Time and Attendance!

When I Work has a lightweight and affordable time clock app that can allow you to easily and conveniently keep records of employee hours, track overtime, and forecast labor costs. More than 50,000 business owners rely on When I Work for tracking time, scheduling, and communicating with their employees. With When I Work Time and Attendance, you can:

- Make it easy for employees to clock in and out through intuitive mobile apps and tablet-based terminals

- Receive alerts when an employee doesn’t clock-in or clock-out for the day

- Quickly export timesheets to Excel or send them directly to Quickbooks, Gusto, ADP, and others

- See when an employee is going over their allotted hours for a given period

Still have questions about the new overtime rule? Click here to read through a comprehensive list of FAQs compiled by the DOL.