9 Top Construction Payroll Software

Try When I Work for free

When it comes to construction payroll, HR pros and administrators have many compliance obligations to meet. It can be a struggle to keep up with it all using manual methods, but construction payroll software can help you streamline the process and get the job done with ease.

There are several key things you should know about selecting the right construction payroll software, including:

- Payroll software automates the process.

- Your chosen platform should have strong compliance features.

- Think about the data and reporting features that will be most helpful.

- Make sure the platform you use can support a range of industries.

- Ensure that software support is robust and responsive.

The top 9 construction payroll software options on the market are:

What is construction payroll software?

Construction payroll software streamlines the payroll process by allowing HR managers and administrators to pay workers correctly and on time, while honoring compliance obligations like fringe benefits, prevailing wages, and union policies.

It also generates labor compensation and other types of reports. Some platforms provide automatic tax filing to help companies further reduce compliance risk exposure.

Payroll software for construction companies: comparison table

Keep these essential elements in mind when evaluating your options for construction payroll software.

| Software name | Pricing information | Features and benefits | Customer support |

| Rippling | • Starts at $8/month per user • Contact for a custom quote | • Automated compliance and taxes • App integrations • Mobile app | • Ticket • Live chat |

| HCSS HeavyJob | Contact vendor for a quote | • Easily track and correct time in the field • Export timecards to accounting systems for greater accuracy and compliance | Phone |

| Connecteam | • Free for up to 10 users • Basic plan starting at • $29/month for 30 users plus $0.50 per month per additional user | • Apply different pay rates to the same employee • Export timesheets directly to payroll software Integrate with Quickbooks and other software • Employee self-service and live chat • Manage labor costs by stopping early clock-ins and forgotten clock-outs | • Help center • Video library • Website contact form |

| Gusto | Simple plan starting at $40/month plus $6/month per person | • Automatic tax filing • Benefits tracking • Accounting integrations | • Email • Chat • Phone |

| Payroll4Construction | Contact vendor for a quote | • Payroll for multiple jobs, locations, unions, trades, and pay rates • Automated prevailing wage rates, union reporting and tracking, and • Quickbooks integration | Phone |

| TriNet | Contact vendor for a quote | Full-service payroll administration Integrated time tracking and accounting Automatic withholding Employee self-service portal | • Phone • Chat |

| Deel | Starts at $599/mo. for PEO/EOR services | • Global payroll with one process • Tax and compliance activities • Synced data, custom dashboards, and reports | • 24/7 Live chat • Online contact form |

| SurePayroll | Contact vendor for a quote | • Automatic payroll runs • No-penalty tax filing guarantee • Quickbooks integration | • Phone • Live chat |

| eBacon | Contact vendor for a quote | • Automated certified payroll and tax payments • Employee self-service portal • Prevailing wage and fringe benefits features • One-click reporting | • Phone • Video and Webinar Hub |

Perusing online ratings and reviews of these software options can help you make an informed decision.

9 best construction payroll software

To find the best construction payroll software, you must take a hard look at the features and benefits of each solution. If a platform can help you meet your goals while providing a user-friendly interface and integrating with your existing tools, it’s definitely worth considering.

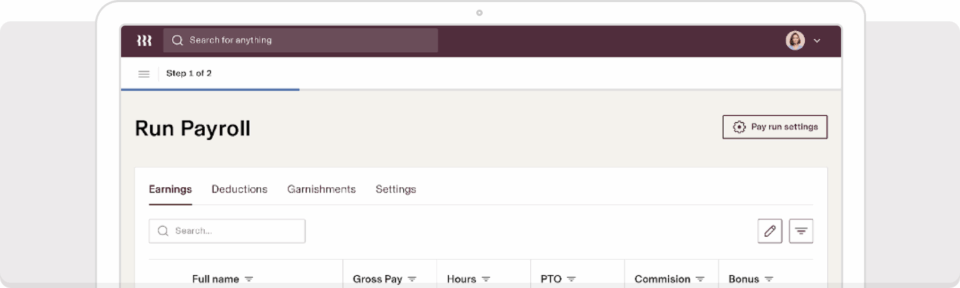

1. Rippling

Rating: 4.8/5 (G2)

Key features:

- Automated international compliance and tax filing

- Integrations with over 400 apps

- Custom reporting

- Self-service employee mobile app

- Run accurate payroll, on time, in just 90 seconds

Rippling is a full-service payroll software that helps you complete the process for any employee anywhere in the world.

With automated compliance and tax filing, you won’t have to worry about your company’s risk exposure. 400-plus app integrations offer versatility, while custom reporting ensures that you can access the data you need to make the right decisions.

BONUS: Rippling is the preferred partner of When I Work, so if you already use When I Work for employee scheduling, you’ll get 6 FREE months of everything Rippling has to offer, including payroll.

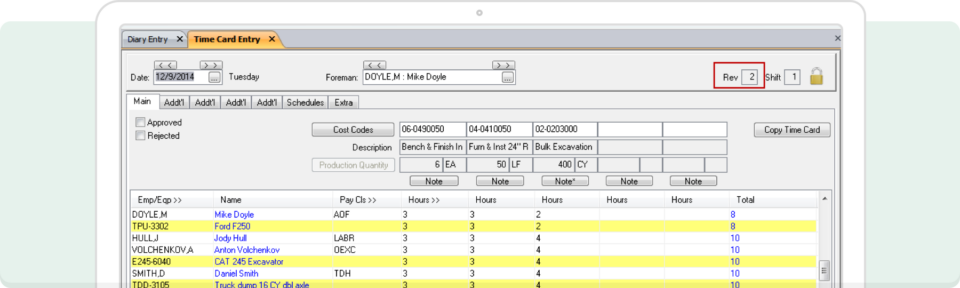

2. HCSS HeavyJob

Rating: N/A

Key features:

- Track and correct time in the field

- Export timecards to accounting systems

HCSS HeavyJob isn’t payroll software, but it does ensure the accuracy of your payroll by allowing workers to manage jobs and timecards in the field.

Once the cards have been verified, you can export the information directly into most major accounting systems. This prevents costly double entry and keeps your entire payroll system accurate and compliant.

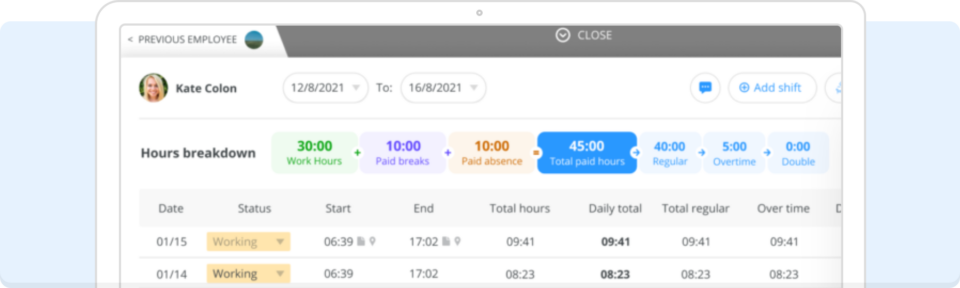

3. Connecteam

Rating: 4.4/5 (G2)

Key features:

- Apply different pay rates per employee

- Export timesheets directly to payroll software

- Integrate with Quickbooks and other software

- Live chat with employees for clarification

Connecteam also isn’t a true payroll software. However, it is a detailed time-tracking solution that collects and maintains all the necessary data to help you run payroll. You can track work hours, apply different pay rates to the same employee, and import and export data with a few clicks.

A slew of automated features help you control scheduling and labor costs and avoid errors and compliance risks. While many users find the platform somewhat slow and expensive, they enjoy good customer service and a convenient, user-friendly employee mobile app.

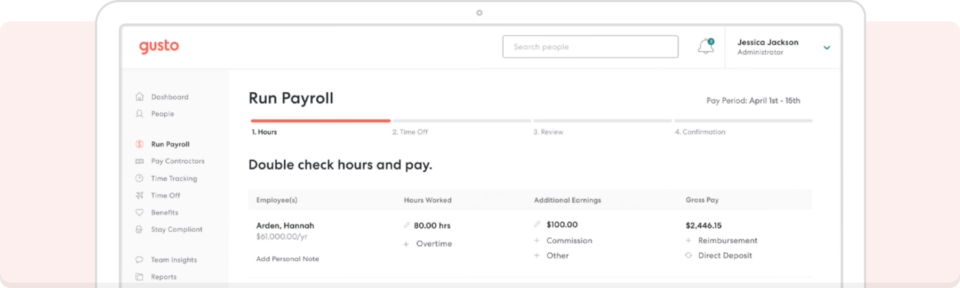

4. Gusto

Rating: 4.5/5 (G2)

Key features:

- Automatic payroll tax filing according to the latest laws

- Accounting software integrations

- Unlimited payrolls

- Built-in time and benefits tracking

Gusto is a popular solution that automates payroll and calculations for every employee across all 50 states. This, coupled with accounting software integration, ensures compliance.

Many love Gusto’s user-friendly interface and customer service and the fact that it’s built for small businesses. Others complain about its speed and serious adjustment issues.

5. Payroll4Construction

Rating: N/A

Key features:

- Multiple jobs, locations, unions, trades, and pay rates

- Automated prevailing wage rates

- Union reporting and tracking

- Support from construction experts

- Quickbooks integration

Payroll4Construction stands out from other generic payroll options due to the industry expertise of its creators and customer service agents.

While some customers complain of poor communication, others praise the quick electronic payroll setup and submission, integrations, and mobile timecard entry from the field, along with the fact that all data flows right into the app.

6. TriNet

Rating: 4.0/5 (G2)

Key features:

- Integrate time tracking and accounting systems

- Calculate and withhold federal, state, and local tax

- Self-service employee portal

- Adaptable compliance

TriNet is a professional employer organization (PEO) organization that provides full-service payroll administration, which explains the cost. Though many feel the customer service is lacking, having a PEO take care of payroll lifts the administrative burden and restores team productivity.

TriNet users enjoy great resources, compliance, and an easy-to-use employee self-service portal.

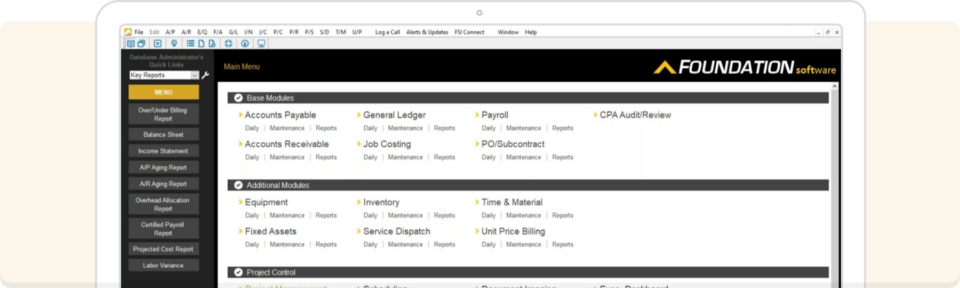

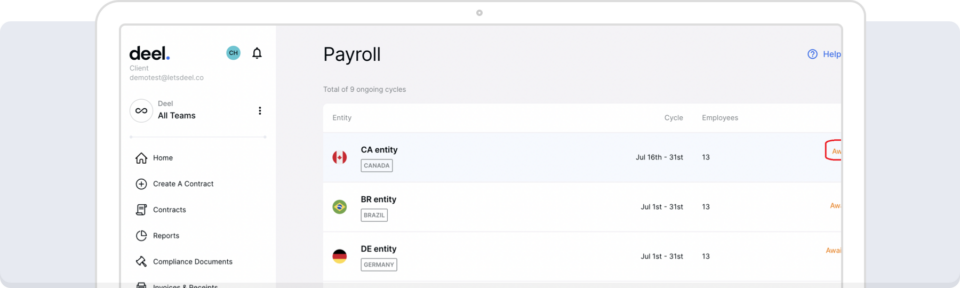

7. Deel

Rating: 4.7/5 (G2)

Key features:

- Consolidate distributed payroll needs into one process

- Localized tax filing and other compliance activities

- Custom dashboards and payroll reports in your chosen currency

Although the service is expensive, many clients feel Deel’s price is justified based on its unique positioning as a global payroll provider.

If you have construction projects worldwide, Deel can help you simplify the payroll and compliance process. You’ll never be in the dark with custom dashboards and reports, and all your data is easily transferred with accounting software and other essential integrations.

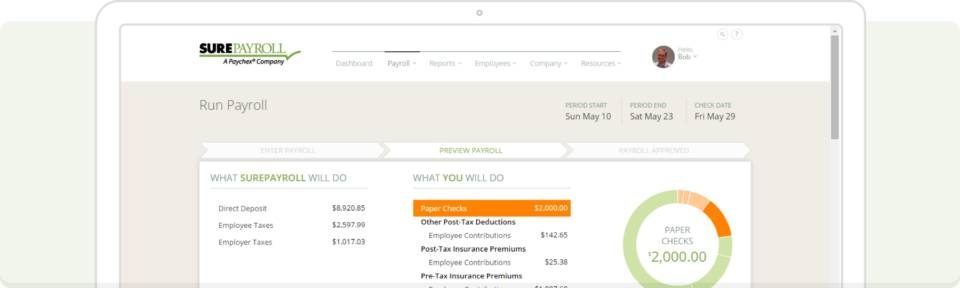

8. SurePayroll

Rating: 4.4/5 (G2)

Key features:

- Automatic payroll

- No-penalty tax calculation and filing guarantee

- Quickbooks integration

As a PayChex brand, SurePayroll gives users the benefit of long-standing expertise. However, many clients complain about the outdated interface and impersonal support. Despite that, others continue to use SurePayroll for its simplified portal and quick payroll entry and processing.

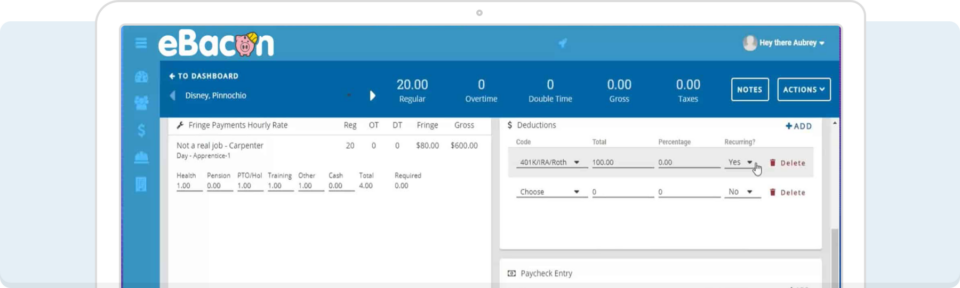

9. eBacon

Rating: N/A

Key features:

- Certified payroll

- Automated tax payments

- Employee self-service portal

- Prevailing wage and fringe benefits compliance

- General ledger integration

eBacon provides construction-specific certified payroll. Elements like prevailing wage and fringe benefits are easy to tackle without jumping through hoops. Though eBacon isn’t forthcoming about its pricing, it provides a robust suite of payroll services that reduce the amount of time required and ensure compliance and accuracy.

Unlock smooth construction payroll management with When I Work

When I Work is the premier construction employee scheduling platform. It’s both cost-effective and well-supported by a team of experts.

When you add in our preferred partner, Rippling, you put the power of automation to help your team maintain compliance, run accurate payroll on time, and acquire data and insights without a clunky or slow user experience.

If you’re already a When I Work customer, you can get 6 FREE months of everything Rippling has to offer. If you’re not, sign up for a free trial of When I Work today and discover how simple scheduling, time tracking, and team messaging can be.